Frequently Asked Questions

-

WHAT IS UNITED CITIZENS BANK’S ROUTING NUMBER?

The routing transit number is 083905685. You can also find this number at the bottom of your checks. It is the nine-digit number to the left of your account number.

-

WHAT ARE THE DAILY LIMITS FOR DEBIT CARDS? CAN IT BE CHANGED?

$1,000 point of sale (POS) per day and $500 for ATM withdrawals. If you need a temporary increase in your POS limit, please call us at 502-532-7392 during normal business hours.

-

CAN MY DEBIT CARD BE USED IN STATES OTHER THAN KENTUCKY?

For fraud protection, debit cards will not automatically work in all states without using a PIN. Most pay at the pump gasoline stations will automatically run your purchase as a credit transaction without giving you the opportunity to enter your PIN. If you will be traveling and want to be able to use your card for all transaction types, please call 502-532-7392 to let us know that you will be traveling.

-

HOW LONG WILL IT TAKE FOR MY DEBIT CARD TO COME IN?

You may receive a debit card the same day you open your account or request a new debit card on an existing account.

-

WHAT FORMS OF ID ARE NEEDED TO OPEN UP AN ACCOUNT?

One form of a non-expired goverment issued picture ID is required to open an account with United Citizens Bank. If you cannot provide any of these, please call your local branch office to discuss alternatives prior to coming in to open the account.

-

HOW DO I STOP PAYMENT ON A CHECK?

You may enter a stop payment to your account through your online banking or by calling 502-532-7392.

-

DO WE HAVE OVERDRAFT PROTECTION?

You may add overdraft protection to your account(s) by setting up an automatic transfer from another existing United Citizens Bank deposit account. You may have the transfer cover an insufficient balance or to maintain a specific balance.

-

DO WE OFFER VA LOANS?

We partner with a secondary market loan vendor that does offer VA loans. We can assist you with the application process through them.

-

WHY DO WE HAVE TO GO THROUGH SO MUCH PAPERWORK FOR A SECONDARY MARKET LOAN?

Government regulations (compliance laws) do require a lot of paperwork. The collection of tax returns, insurance documents, ID’s, verification of employment, early disclosures and disclosures again at closing. We try to make it as easy as possible but the information has to be gathered and the disclosures have to be signed.

-

WHAT DO I NEED TO APPLY FOR A LOAN?

Two forms of current ID’s (a driver license and social security card for example), income verification (this can be pay stubs, tax returns, W-2, or benefit award letter for example) and a completed signed application. Any of our loan officers can talk with you to be more specific about what might be needed.

-

HOW LONG WILL IT TAKE TO GET AN ANSWER ON MY LOAN APPLICATION?

Depending on the amount and complexity of the request it is possible to get an answer in one hour or less.

-

WHAT IS “PRINCIPAL”?

Principal is the total amount of money you borrow. As you make payments to a loan the interest is usually paid first then the remainder of the payment reduces the principal you owe.

-

WHAT DOES “SECURED” AND “UNSECURED” MEAN?

Secured means that you are pledging something (a car for example) as collateral in order to get a loan. Unsecured means that you are requesting a loan with nothing pledged as collateral. An unsecured loan usually has a higher interest rate and shorter term. (a credit card or student loan are examples of unsecured loans and a home mortgage loan would be a secured loan).

-

WHAT DOES “COLLATERAL” MEAN?

Collateral is what someone puts up to secure their loan. A vehicle, real estate and a savings account are examples of collateral that could be used. When you pledge collateral for loan and you do not pay the loan, that collateral may be taken and sold, with the proceeds used to pay on the loan.

-

HOW DO I BUILD MY CREDIT IF I HAVE NONE?

A very convenient way to start building a credit history is to put some money in a savings account and then borrow money using the savings account as collateral.

-

HOW DO I ACCESS MY LINE OF CREDIT?

If you have an Equicheck (Home Equity Line of Credit) with us you can use one of the checks you were given at the time you opened the loan, for this type and others you can transfer from a line of credit if you have online banking and a deposit account with us, call your loan officer and they can transfer to an account or issue a cashier check for you or come into a branch and request an advance.

-

HOW MUCH MONEY DOWN DO I NEED TO BUY A HOUSE?

Every situation is different depending on the purpose of the loan and the type of real estate. Talk with any of our loan officers for more information.

-

IS THE LOAN APPROVAL BASED ON CREDIT SCORE?

We do not subscribe to the credit score from the credit bureau company but we do use information from your credit history in our decision process.

-

CAN I CHANGE MY PIN (PERSONAL IDENTIFICATION NUMBER) ON MY DEBIT CARD?

Yes. If you know your existing PIN, you can change it at one if our ATM machines. If you do not know your PIN, you can choose a pin inside at any of our branch locations.

-

WHY DOES MY PASSWORD EXPIRE SO QUICKLY ON MY ONLINE BANKING/MOBILE APP?

This is a security feature to ensure that you are the only authorized person able to view and make transactions on that account, and to protect you from anything potentially that could happen to your account.

-

DO YOU DO CASH ADVANCES ON CREDIT CARDS?

We do not do cash advances. We have an ATM machines at three of our offices from which you can use your card to withdraw cash using a PIN (personal identification number.) Fees from the card issuing institution may apply and are separated from any United Citizens Bank ATM fee.

-

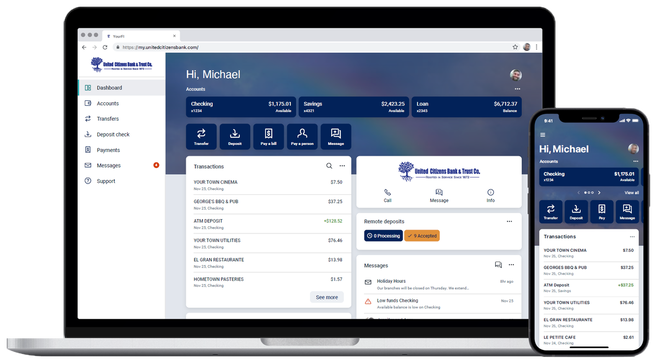

HOW CAN I ACCESS MY ACCOUNTS ONLINE?

United Citizens Bank has two convenient ways to access your accounts electronically. UCOnline allows you to view via your PC desktop all of your accounts balances, see transactions and check images, make account transfers, create stop payments, and pay bills. UCMobile allows the same access at UCOnline, but in a form display friendly for cellular telephones and notepads.

-

HOW CAN I ACCESS MY ACCOUNT INFORMATION ON THE TELEPHONE?

Anytime Banker allows you to call our automated system to retrieve balances, transfter funds, create stop payments with the added ability to freeze your debit card immediately should it be lost or stolen. And, of course, you can always call one of our branch offices and an employee will be happy to get you the information you need.

-

HOW DO I RESET MY ONLINE BANKING PASSWORD?